How Much Do You Need?

Term vs. Whole Life

Term life insurance lasts for a set period of time, such as 10 or 20 years. So, when calculating coverage, think about how long you want your term policy to last. For example, if you need life insurance to cover your income until your kids go to college, you may need a 20-year policy. Alternatively, if you want to cover your mortgage, you may need a 30-year term policy.

Whole life insurance lasts your entire life, so you’ll want to take into account final expenses, such as burial costs. Your insurance needs may change over your lifetime, so consider any future plans like buying a house, having a family or increases in salary.

What type of life insurance is best for you?

What are your goals?

Pay off my debts?

Yes or No

Provide for my children?

Yes or No

Provide for funeral expenses?

Yes or No

Leave an inheritance?

Yes or No

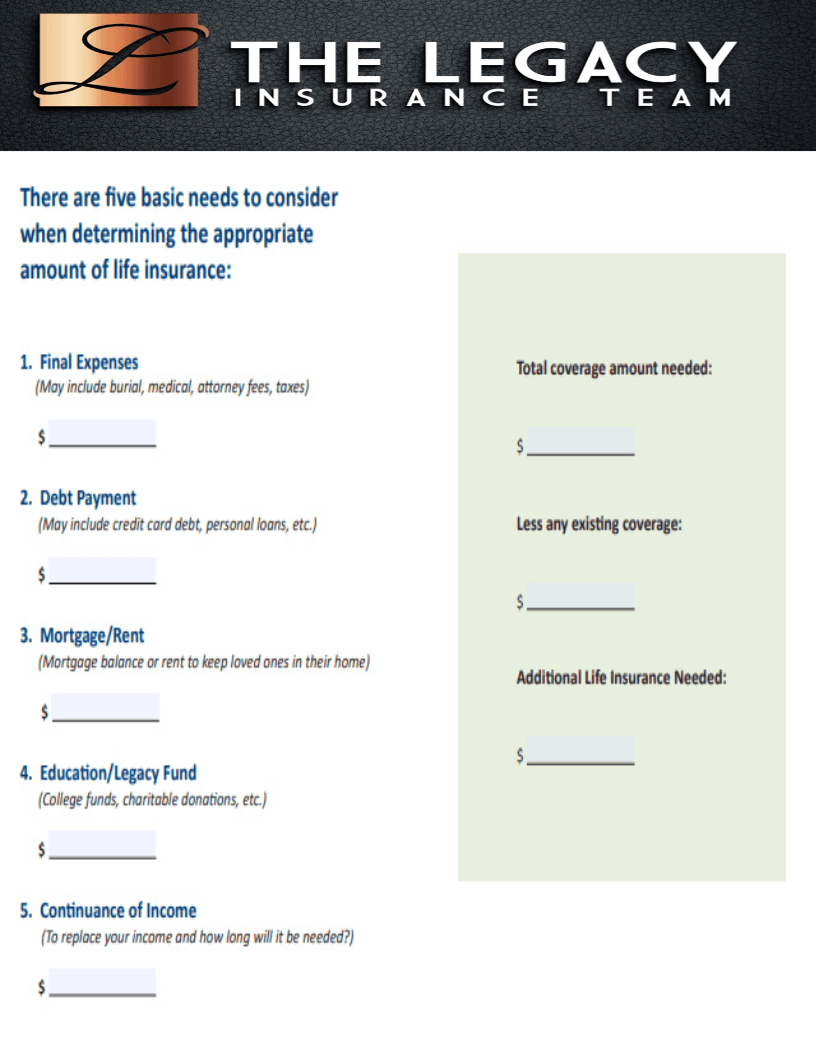

How to manually calculate how much life insurance you need

Follow this general philosophy to find your own target coverage amount: financial obligations minus liquid assets.

Step 1: Add up the following items to calculate your financial obligations.

- Your annual salary multiplied by the number of years you want to replace that income.

- Your mortgage balance.

- Any other debts.

- Any future needs such as college fees and funeral costs.

- The cost to replace services that a stay-at-home parent provides, such as child care, if applicable.

Step 2: From that total, subtract liquid assets, such as savings, existing college funds and current life insurance policies.

The number you’re left with is the amount of life insurance you need.

3 ways to estimate how much life insurance you need

If you want to quickly determine your existing life insurance needs, an estimate can be an easy way to get a value. These methods are better than a random guess but often fail to account for important parts of your financial life.

Use the life insurance calculators above to get a more refined idea of how much coverage you need, and then compare that value to these estimates.

1. Multiply your income by 10

The “10 times income” guideline is often shared online, but it doesn’t take a detailed look at your family’s needs, nor does it take into account your savings or existing life insurance policies. And it doesn’t provide a coverage amount for stay-at-home parents, who should have coverage even if they don’t make an income.

The value of a stay-at-home parent’s work needs to be replaced if he or she dies. At a bare minimum, the remaining parent would have to pay someone to provide the services, such as child care, that the stay-at-home parent provided for free.

2. Buy 10 times your income, plus $100,000 per child for college expenses

This formula adds another layer to the "10 times income" rule by including additional coverage for your child’s education. College and other education expenses are an important component of your life insurance calculation if you have kids. However, this method still doesn’t take a deep look at all of your family’s needs, assets or any life insurance coverage already in place.

3. Use the DIME formula

This formula encourages you to take a more detailed look at your finances than the other two. DIME stands for debt, income, mortgage and education, four areas that you should account for when calculating your life insurance needs.

- Debt and final expenses: Add up your debts, other than your mortgage, plus an estimate of your funeral expenses.

- Income: Decide for how many years your family would need support, and multiply your annual income by that number.

- Mortgage: Calculate the amount you need to pay off your mortgage.

- Education: Estimate the cost of sending your kids to school and college.

By adding all of these obligations together, you get a much more well-rounded view of your needs. However, while this formula is more comprehensive, it doesn’t account for the life insurance coverage and savings you already have. It also doesn’t consider the unpaid contributions a stay-at-home parent makes.

Contact Us Today!

(202) 495-1049

Need Analysis Form